Small businesses and financial managers, are you bogged down by manual invoicing? An automated invoicing system could be the game-changer your business needs. This article will explore what automated invoicing is, its benefits, how to implement it, and the future trends shaping this technology. By the end, you’ll understand why it’s time to leave manual methods behind and step into the future of invoicing.

What Is an Automated Invoicing System?

An automated invoicing system is software that handles the entire invoicing process—from invoice creation and delivery to payment tracking—without manual intervention. It uses the data you provide to automatically generate and send invoices to customers, saving time and reducing errors.

How Does It Work?

Automated invoicing operates through integration with your existing accounting software or ERP (Enterprise Resource Planning) systems. Here’s how it typically works:

- You input client details, services rendered, and pricing.

- The system generates a professional invoice with pre-set templates.

- It sends the invoice to the client through email or other preferred channels.

- Payment reminders and follow-ups are automated if the invoice isn’t paid on time.

- The platform tracks payment status and updates your records instantly.

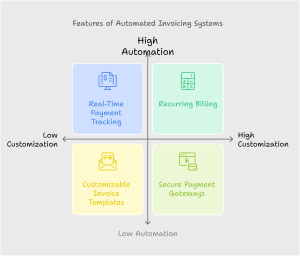

Key Features of Automated Invoicing Systems

- Customizable Invoice Templates: Create professional invoices tailored to your brand.

- Recurring Billing: Automate regular invoices for subscription-based services.

- Secure Payment Gateways: Allow clients to pay directly via secure payment links.

- Real-Time Payment Tracking: Know the status of every invoice at a glance.

- Analytics and Reporting: Get insights into revenue trends, outstanding payments, and more.

Advantages for Small Business Owners

An automated invoicing system offers substantial advantages to small business owners, including:

1. Time and Cost Savings

Manual invoicing is time-intensive. Automating the process allows you and your team to focus on more critical tasks, cutting administrative hours significantly. Additionally, it reduces errors that could lead to costly corrections.

2. Enhanced Accuracy and Efficiency

By automating calculations and data entry, the system minimizes errors, ensuring accurate invoices every time. Automated reminders also reduce the likelihood of late payments, improving cash flow.

3. Improved Customer Experience

A seamless invoicing process leaves a positive impression on your clients. From professional-looking invoices to secure payment options, customers appreciate the ease and efficiency.

4. Better Cash Flow Management

With real-time tracking and automated payment reminders, cash flow management becomes more predictable and controllable, enabling financial stability.

Steps to Implement an Automated Invoicing System

Implementing an automated invoicing system might seem daunting, but with a step-by-step approach, it can be straightforward.

Step 1. Evaluate Your Business Needs

Identify your invoicing challenges. Are late payments a significant issue? Do you send multiple invoices monthly? Understanding your needs will help you choose the most suitable system.

Step 2. Research and Select Software

Explore platforms that align with your business size and industry. Compare features, pricing, and integrations. Popular choices include FreshBooks, QuickBooks, and Zhou Invoice.

Step 3. Set Up and Customize

After choosing a platform, customize the system. Upload your branding elements (logos, colors), set tax rules, and create templates for invoices.

Step 4. Integrate with Existing Systems

Link your invoicing system to your accounting or ERP software for seamless data transfer. Ensure compatibility to avoid downtime or syncing issues.

Step 5. Train Your Team

Educate your team on using the software efficiently. Most platforms provide tutorials or customer support for assistance during setup.

Step 6. Test and Refine

Run test scenarios to ensure the system works as expected. Use trial invoices to identify and address any issues before full implementation.

Best Practices for Automated Invoicing

To maximize the benefits of your automated invoicing system, consider these best practices:

Personalize Your Templates

Use invoice templates with your logo, brand colors, and a professional layout to maintain your brand identity.

Prioritize Compliance and Security

Ensure your system complies with tax regulations and data protection laws. Choose software with robust encryption and fraud detection.

Manage Overdue Payments

Set up automated reminder emails for overdue invoices. Some systems allow escalating reminders, becoming more urgent with each successive attempt.

Leverage Analytics

Use the reporting features to analyze revenue trends and outstanding payments. These insights can inform business decisions and financial strategies.

The Future of Automated Invoicing

Trends in Technology

Artificial Intelligence (AI) and machine learning are advancing automated invoicing systems. These technologies predict delays, optimize payment schedules, and provide smarter financial insights.

Predictions for Small Businesses

- Complete Integration: Future tools will seamlessly integrate with CRMs, project management, and inventory systems.

- Blockchain Payments: Secure, transparent payment methods using blockchain could become a reality.

- Global Adaptability: Systems will accommodate international regulations, making cross-border transactions smoother.

Why Your Business Needs Automated Invoicing Now

The shift to automation is no longer a luxury; it’s a necessity to stay competitive in the modern business landscape. An automated invoicing system improves efficiency, enhances customer satisfaction, and secures cash flow—helping small businesses succeed.

Want to explore your options? Get started with an automated invoicing solution tailored to your needs. Contact us today to learn more about how we can assist you.