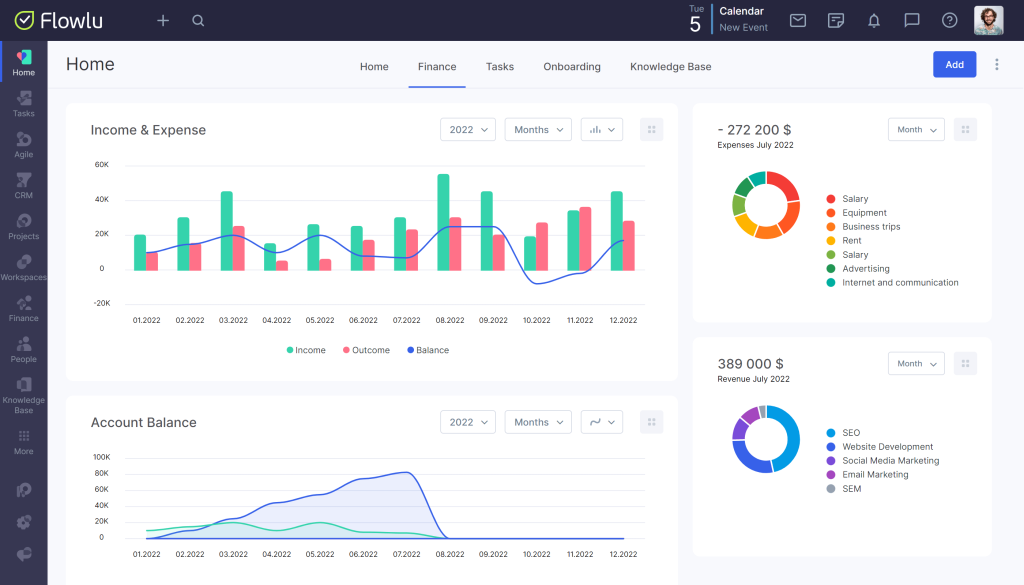

Managing finances is crucial for businesses. Financial management software can help simplify this task.

Financial management software offers tools to track expenses, manage budgets, and generate financial reports. It brings efficiency and accuracy to financial tasks, reducing human errors. Businesses of all sizes can benefit from using such software. From small startups to large corporations, financial management software provides valuable insights into financial health.

It helps in making informed decisions, saving time, and ensuring compliance with financial regulations. Understanding the features and benefits of financial management software can help you choose the right one for your needs. In this blog post, we will explore the key aspects of financial management software and how it can enhance your business operations.

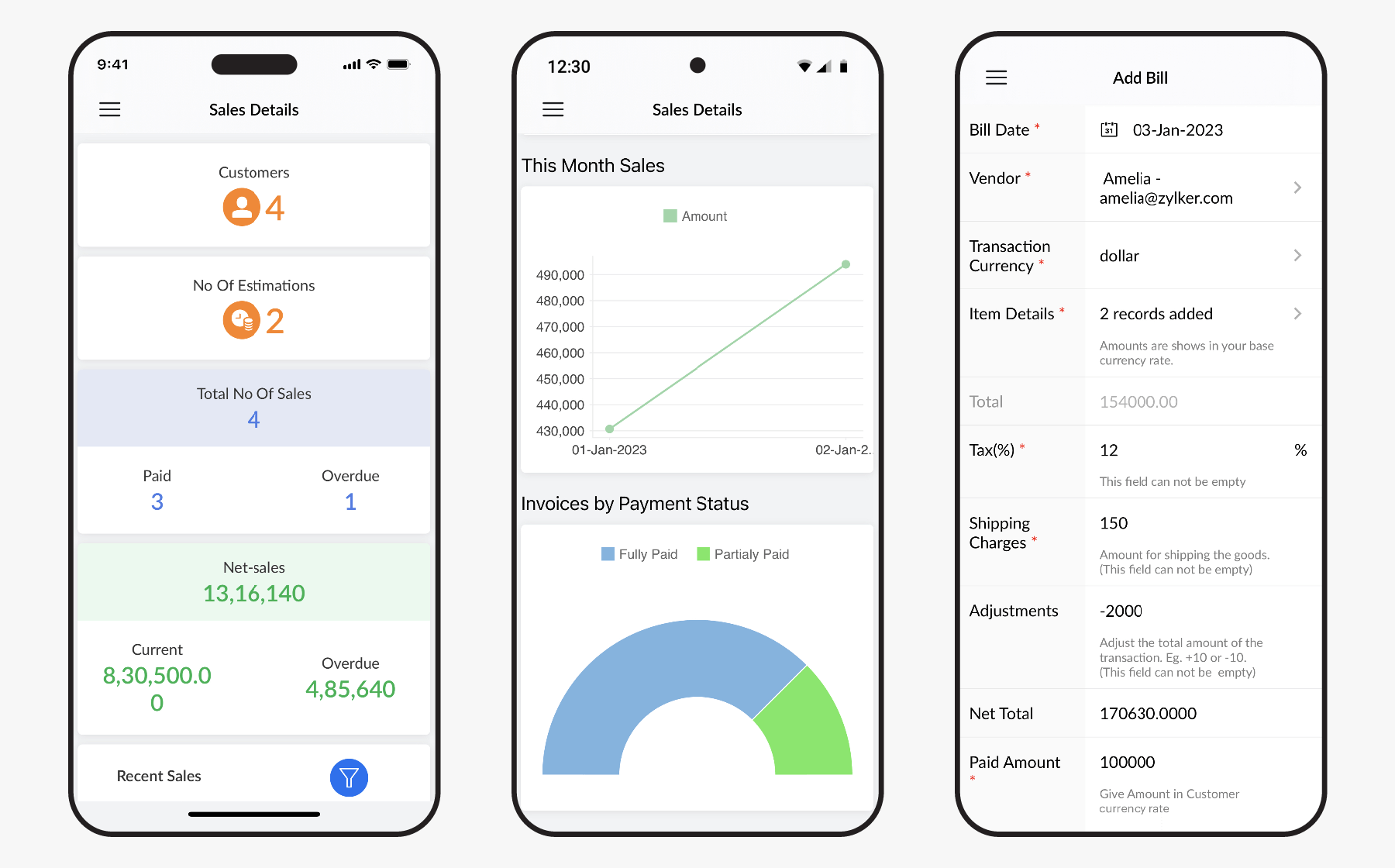

Credit: www.zoho.com

Introduction To Financial Management Software

Financial management software is a tool that helps you manage your finances. It simplifies tasks such as budgeting, tracking expenses, and managing accounts. This software is useful for both individuals and businesses. It helps you make informed financial decisions. Let’s explore the benefits and features of financial management software.

Benefits Of Using Software

Using financial management software saves you time. It automates many manual tasks. You can easily track your income and expenses. This helps you stay within your budget. The software provides accurate financial reports. These reports help you understand your financial health. It also helps in reducing errors. You can avoid costly mistakes by using the software.

Another benefit is security. Your financial data is safe and secure. The software uses encryption to protect your information. This ensures your data remains confidential. You can also access your financial data anytime, anywhere. This is helpful for busy individuals and businesses. It allows you to make quick financial decisions.

Common Features

Financial management software offers many features. One key feature is budgeting. You can set up a budget and track your spending. This helps you manage your money better. Another feature is expense tracking. You can categorize and monitor your expenses. This helps you see where your money goes.

The software also includes account management. You can link your bank accounts and credit cards. This allows you to see all your financial information in one place. Financial reports are another important feature. The software generates reports like profit and loss statements. This helps you analyze your financial performance.

Other features include bill payment reminders. You can set up alerts to avoid late payments. The software also supports tax management. It helps you prepare for tax season. You can organize your receipts and track your deductions. This makes filing taxes easier.

Choosing The Right Software

Choosing the right financial management software is crucial for any business. It helps you manage your finances efficiently. But with so many options, it can be overwhelming. Here are some tips to help you make the right choice.

Assessing Your Needs

Before you start comparing software, assess your business needs. Make a list of key features you require. Think about:

- Budgeting and forecasting

- Invoice management

- Expense tracking

- Payroll processing

- Reporting capabilities

Consider the size of your business. A small business may not need complex features. Larger businesses might need more advanced tools.

Comparing Top Options

Once you know your needs, compare top software options. Look at user reviews and ratings. Here are a few popular choices:

| Software | Key Features | Pricing |

|---|---|---|

| QuickBooks | Invoicing, expense tracking, payroll | Starts at $25/month |

| FreshBooks | Time tracking, invoicing, reporting | Starts at $15/month |

| Wave | Free invoicing, accounting, receipt scanning | Free |

Check if the software offers a free trial. This allows you to test it before committing. Also, ensure the software integrates with other tools you use. This can save time and reduce errors.

Setting Up Your Software

Setting up your financial management software can seem daunting. But with the right steps, it becomes straightforward. This guide covers the essential aspects: installation, configuration, and importing financial data.

Installation And Configuration

First, download the software from the official website. Make sure it matches your operating system. Follow the installation prompts. Once installed, open the software. You will need to configure it to suit your needs.

Here are the steps to configure your software:

- Set up your user profile.

- Choose your preferred currency.

- Link your bank accounts.

- Customize the dashboard for easy access.

Each software might have different settings. Refer to the user manual for specific instructions. Proper configuration helps in accurate financial tracking.

Importing Financial Data

After configuration, you need to import your financial data. This includes bank statements, invoices, and other financial records.

Follow these steps to import data:

- Export financial data from your bank or other sources.

- Save the data in a compatible format, such as CSV or Excel.

- Open your financial management software.

- Navigate to the import section.

- Upload your saved financial data files.

- Map the data fields correctly.

- Check for errors and correct them.

Importing data ensures you have a complete financial picture. It helps in better analysis and decision-making.

Use the software’s help section if you face issues. Accurate data import is crucial for effective financial management.

Credit: www.zoho.com

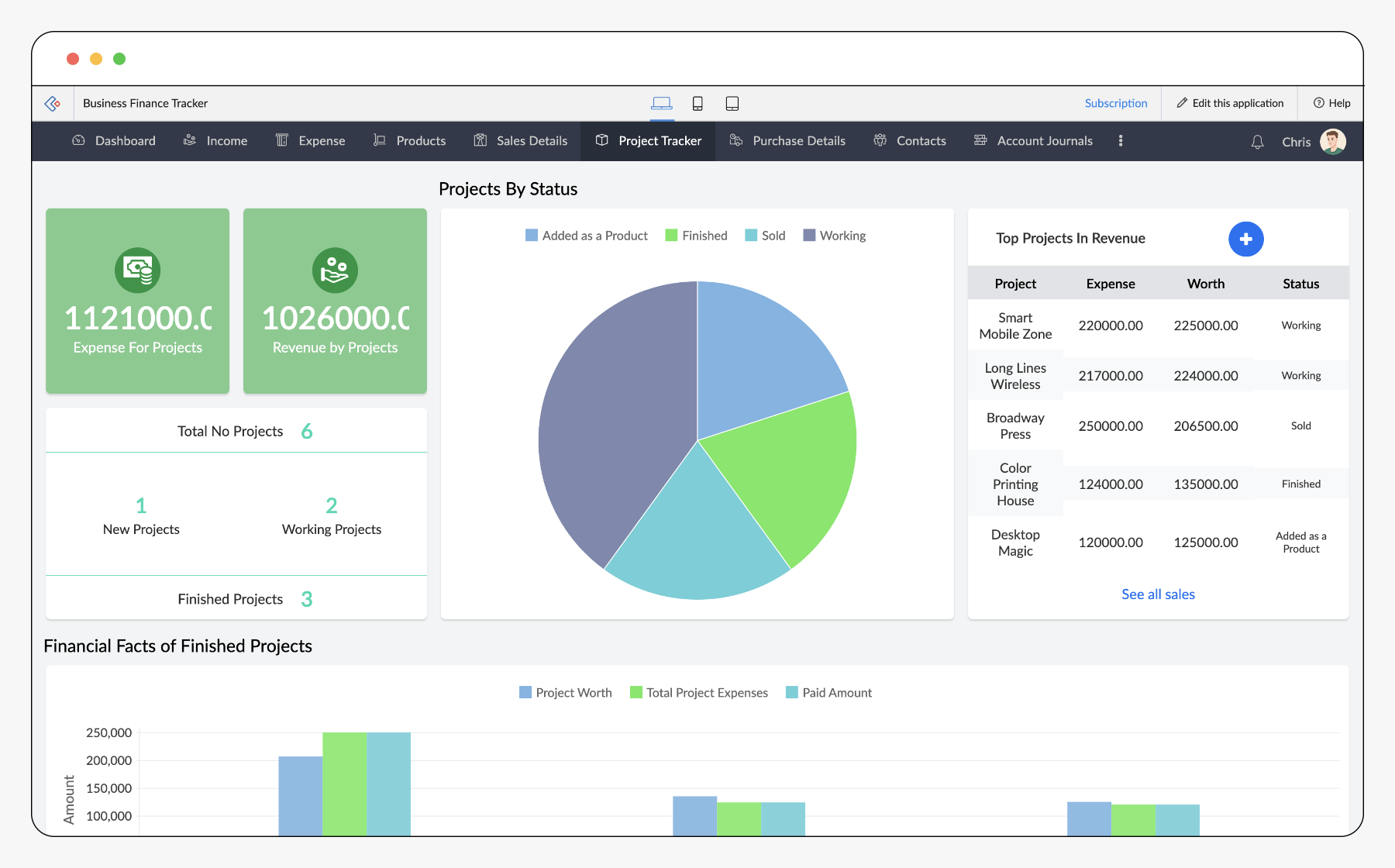

Optimizing Financial Processes

Efficient financial management is crucial for any business. Optimizing financial processes can save time and reduce errors. Financial Management Software (FMS) plays a significant role in this. It streamlines operations, enhances accuracy, and provides valuable insights. Let’s explore how FMS can help in optimizing financial processes.

Automating Transactions

Manual data entry is prone to errors and time-consuming. Automating transactions can significantly reduce these issues. Financial Management Software automates repetitive tasks. This includes invoicing, payroll, and expense tracking. Automation ensures accuracy and saves valuable time.

Key benefits of automating transactions include:

- Reduced manual errors

- Faster processing times

- Consistent and accurate records

Budgeting And Forecasting

Effective budgeting and forecasting are essential for financial health. Financial Management Software helps in creating accurate budgets. It also provides tools for realistic forecasting. This software uses historical data and predictive analytics.

Here is how FMS aids in budgeting and forecasting:

| Aspect | How FMS Helps |

|---|---|

| Data Analysis | Analyzes past financial data |

| Trend Identification | Identifies spending trends |

| Scenario Planning | Creates “what-if” scenarios |

FMS provides a clear picture of financial health. It helps businesses make informed decisions. This is crucial for long-term success.

Ensuring Security And Compliance

Financial management software plays a crucial role in handling your finances. It is vital to ensure that this software maintains high standards of security and compliance. This helps protect sensitive financial information and adhere to industry regulations. Let’s dive into the key aspects of ensuring security and compliance in financial management software.

Protecting Financial Data

Protecting financial data is the top priority for any financial management software. This software must have strong encryption methods. Encryption ensures that data is unreadable to unauthorized users. Below are some key measures to protect financial data:

- Implementing strong password policies

- Using multi-factor authentication (MFA)

- Regularly updating software to patch vulnerabilities

- Conducting regular security audits

These measures help in safeguarding financial data against unauthorized access and breaches.

Adhering To Regulations

Adhering to regulations is essential for financial management software. Compliance with legal and industry standards ensures the software operates within legal boundaries. Here are some important regulations to consider:

| Regulation | Description |

|---|---|

| GDPR | Protects the data privacy of individuals in the EU. |

| SOX | Ensures accuracy in financial reporting for public companies. |

| PCI-DSS | Protects cardholder data during transactions. |

Financial management software must comply with these regulations to avoid penalties and maintain trust.

Maximizing Software Benefits

Maximizing the benefits of financial management software can save time and money. Proper use can enhance decision-making and streamline operations. This section explores practical ways to get the most from your software.

Training And Support

Investing in training is essential for maximizing software benefits. Training ensures that users understand all features. This knowledge leads to efficient use and better results. Many software providers offer comprehensive training programs. These can be online courses, webinars, or in-person sessions. Support services are equally important. Access to customer support can resolve issues quickly. Look for software with 24/7 support options. This ensures help is available whenever needed. Training and support are key to leveraging the full potential of financial management software.

Regular Updates

Regular updates are crucial for optimal software performance. Updates often include new features and improvements. They can enhance security and fix bugs. Staying updated ensures you use the most efficient version. Check for updates regularly and install them promptly. Many software providers offer automatic update options. This can simplify the process and ensure you never miss an update. Regular updates keep your software running smoothly and securely.

Credit: www.cflowapps.com

Frequently Asked Questions

What Is Financial Management Software?

Financial management software helps manage finances. It tracks expenses, budgets, and financial planning.

How Does Financial Management Software Help Businesses?

It helps businesses by organizing financial data. It simplifies tasks like budgeting, forecasting, and tracking expenses.

Can Financial Management Software Track Expenses?

Yes, it tracks all expenses. It helps in monitoring and controlling spending.

Is Financial Management Software Secure?

Yes, it is secure. It uses encryption to protect your financial data.

What Features Should I Look For In Financial Management Software?

Look for features like budgeting, expense tracking, reporting, and security. These are essential for effective financial management.

Conclusion

Financial management software simplifies managing your finances. It saves time and reduces errors. You gain clear insights into your financial health. Track expenses, create budgets, and plan for the future. This software supports better decision-making. Many options are available to suit different needs.

Choose one that fits your lifestyle and business goals. Invest in financial management software today. Enjoy a more organized and stress-free financial life.