Expense reports are essential for tracking business expenses. They ensure financial accuracy and help in budgeting.

Managing expenses can be daunting without the right tools. With businesses growing and expenses varying, it’s crucial to have a structured way to record and review spending. Expense reports serve this purpose well. They not only track where money goes but also help identify areas to cut costs.

In this blog, we’ll explore the importance of expense reports, how they work, and tips to make them more efficient. Understanding these reports can save time and reduce financial errors. Let’s dive in and see how you can manage your expenses better.

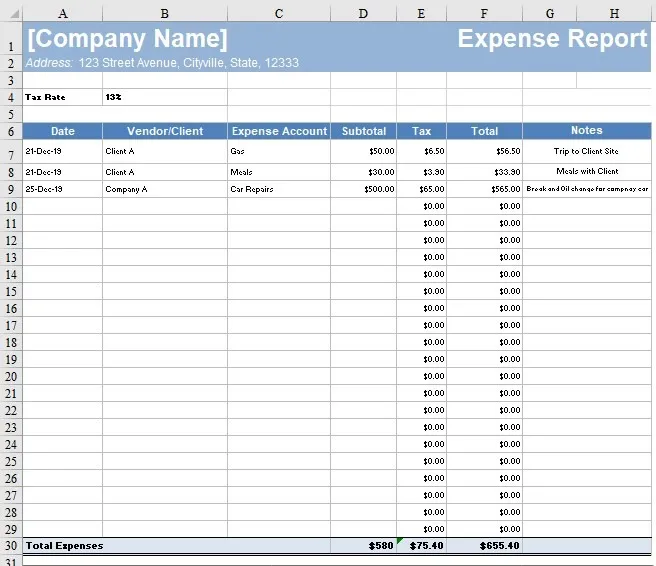

Credit: www.freshbooks.com

Importance Of Expense Reports

Expense reports are vital for managing a company’s financial health. They help track spending, reimburse employees, and ensure financial compliance. Without proper reports, financial chaos can ensue, making it difficult to manage resources effectively.

Streamlining Financial Management

Expense reports are essential for streamlining financial management. They provide a clear record of all company spending. This helps accountants and managers track expenses and stay organized.

- Clear documentation of expenses

- Easy tracking of spending trends

- Improved financial oversight

With accurate reports, companies can quickly identify areas where they are overspending. This enables them to make better financial decisions.

Enhancing Budget Control

Expense reports play a crucial role in enhancing budget control. They offer detailed insights into where money is being spent. This helps companies stick to their budgets and avoid unnecessary costs.

- Monitor spending against budget

- Identify cost-saving opportunities

- Ensure financial accountability

Regularly reviewing expense reports allows managers to adjust budgets as needed. This ensures that resources are allocated efficiently and effectively.

| Benefit | Description |

|---|---|

| Transparency | Clear records of all expenses |

| Accountability | Employees accountable for their spending |

| Efficiency | Quick identification of overspending |

In summary, expense reports are indispensable for any business. They streamline financial management and enhance budget control, ensuring a company’s financial stability.

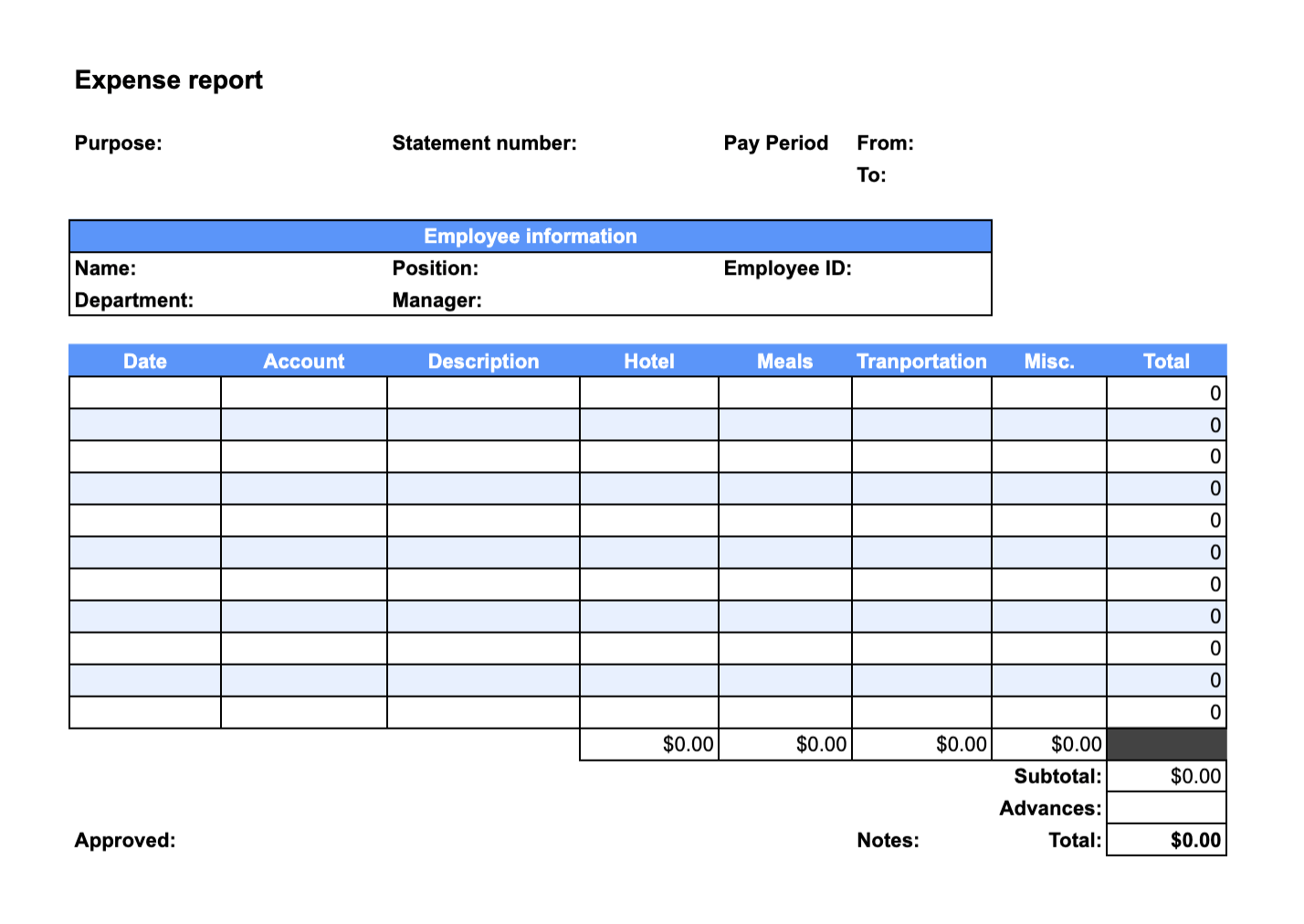

Credit: www.indeed.com

Common Challenges

Managing expense reports can be a daunting task for many businesses. There are several common challenges that employees and managers face when dealing with expense reports. These challenges can lead to errors, delays, and frustration. Let’s discuss some of these common challenges in detail.

Manual Data Entry

Manual data entry is one of the biggest hurdles in managing expense reports. Employees often have to enter data from receipts and invoices manually. This process is time-consuming and prone to errors.

Here are some common issues with manual data entry:

- Human error: Mistakes are common when typing numbers and dates.

- Time-consuming: Entering data manually takes a lot of time.

- Inconsistency: Different employees may enter data in different formats.

Receipt Management

Managing receipts is another significant challenge. Employees often lose receipts or forget to submit them on time. This can lead to incomplete expense reports and delays in reimbursement.

Some common issues with receipt management include:

- Lost receipts: Paper receipts can easily be misplaced.

- Late submission: Employees may forget to submit receipts promptly.

- Storage issues: Keeping track of numerous paper receipts can be difficult.

Addressing these challenges is crucial for efficient expense report management. Automating data entry and using digital receipt management systems can help. These solutions can save time, reduce errors, and improve consistency.

Digital Solutions

Digital solutions for expense reports have changed the way businesses manage finances. These tools save time and reduce errors. Let’s explore some of the best digital solutions available today.

Automated Reporting Tools

Automated reporting tools streamline the process of creating expense reports. These tools collect data and generate reports without much human intervention.

With automated tools, you can:

- Reduce manual data entry.

- Ensure accuracy in reporting.

- Save valuable time.

Examples of popular automated reporting tools include:

| Tool Name | Features |

|---|---|

| Expensify | OCR receipt scanning, integration with accounting software |

| SAP Concur | Travel booking, expense management, real-time data sync |

Mobile Expense Tracking Apps

Mobile expense tracking apps offer the flexibility to manage expenses on the go. These apps allow users to record expenses from their smartphones.

Benefits of mobile expense tracking apps:

- Easy receipt capture using the phone camera.

- Real-time expense tracking.

- Automatic categorization of expenses.

Popular mobile expense tracking apps include:

- Expensify: Known for its user-friendly interface and OCR technology.

- Zoho Expense: Offers automatic mileage tracking and multi-currency support.

- Rydoo: Provides seamless integration with various accounting systems.

Digital solutions simplify expense management. They provide accuracy and save time. Businesses benefit greatly from these tools.

Best Practices

Managing expense reports effectively is crucial for any organization. Following best practices can help streamline the process and ensure accuracy. Here are some key strategies to consider.

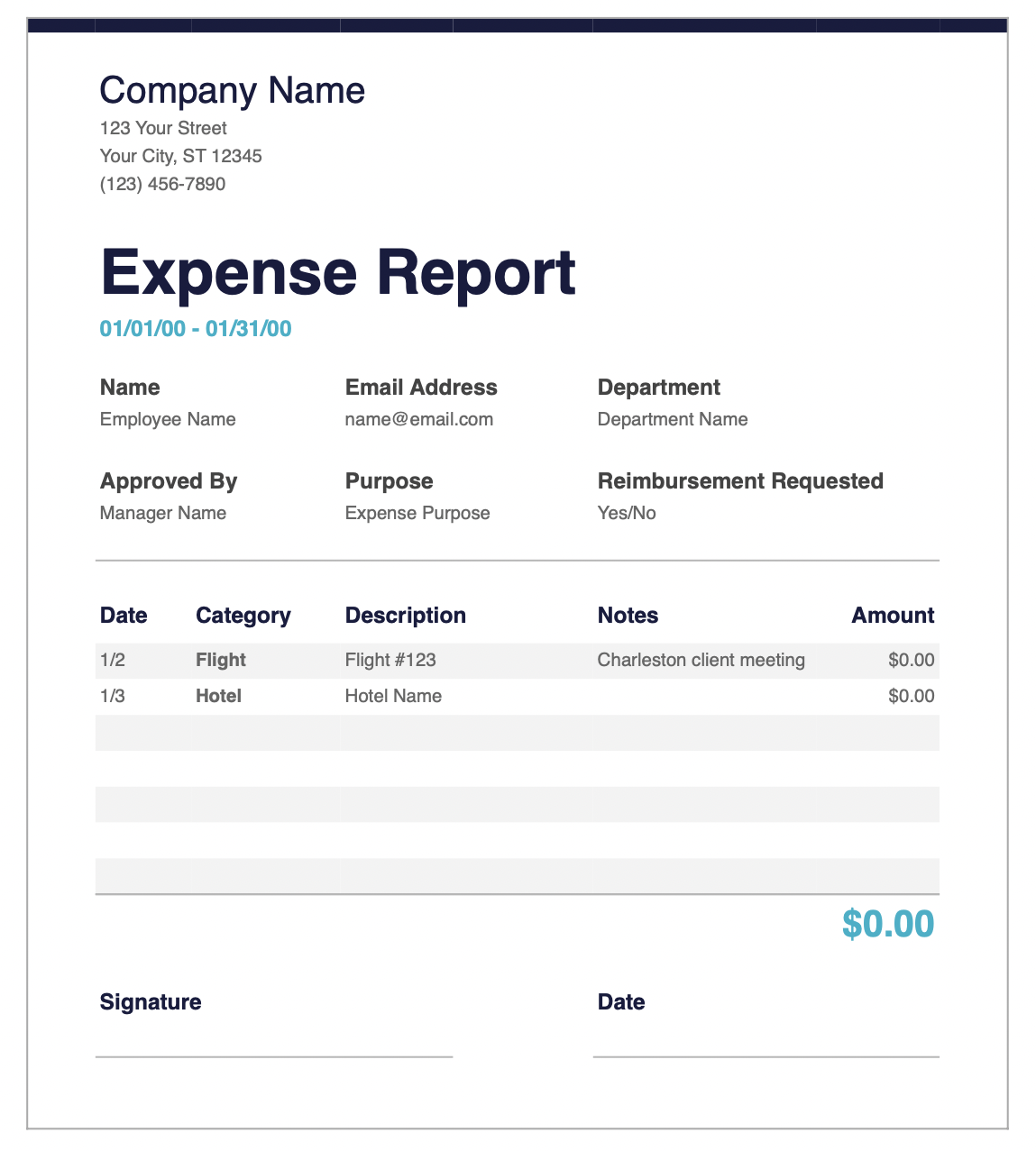

Consistent Documentation

Keep a uniform format for all expense reports. This makes it easier to review and understand. Use templates to save time and maintain consistency. Include all necessary details like date, amount, and purpose of the expense.

Attach receipts for every expense. Digital copies are often easier to store and retrieve. Ensure all submissions follow the same guidelines. This reduces errors and confusion.

Regular Review Cycles

Set a regular schedule for reviewing expense reports. Monthly reviews work well for most organizations. This helps catch errors early and prevents backlog.

Involve key team members in the review process. They can provide insights and ensure compliance with company policies. Use software tools to automate reminders and track progress. This keeps everyone on the same page.

Implementation Tips

Implementing expense report systems can be challenging. Proper implementation ensures smooth operations. Here are some tips to help you get started.

Employee Training

Training employees is crucial. They need to understand the process. Conduct training sessions to explain the steps. Provide examples of good and bad reports. Encourage questions and feedback. This will help employees feel confident. Regularly update training materials. Keep them aligned with any changes in the process.

Choosing The Right Software

Choosing the right software is essential. It should be user-friendly and intuitive. Look for software with easy navigation. Ensure it integrates with existing systems. Check for mobile compatibility. This allows employees to submit reports on the go. Read reviews and get recommendations. Test different software options before making a decision.

Credit: www.simplywise.com

Future Trends

Expense reports are evolving rapidly. The future holds exciting trends. Two major trends include AI and Machine Learning and Blockchain Technology. These trends promise to make expense reporting more efficient and secure.

Ai And Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are changing expense reports. They automate and streamline processes. This reduces human error and saves time.

Here are some benefits of AI and ML in expense reporting:

- Automatic Data Entry: AI can scan and input data from receipts.

- Fraud Detection: ML algorithms detect suspicious activities.

- Expense Categorization: AI classifies expenses into correct categories.

- Predictive Analysis: ML predicts future expenses based on past data.

These benefits improve accuracy and efficiency. They also provide valuable insights for better decision-making.

Blockchain Technology

Blockchain technology is also transforming expense reports. It offers a secure and transparent way to handle transactions.

Key features of blockchain in expense reporting include:

- Immutable Records: Once recorded, data cannot be altered.

- Transparency: All transactions are visible to authorized users.

- Decentralization: Data is stored across multiple locations, reducing risk.

- Smart Contracts: Automates payments when conditions are met.

These features enhance security and trust. They ensure accurate and reliable expense reporting.

The future of expense reports looks promising. With AI, ML, and blockchain, the process will become more efficient, secure, and insightful.

Frequently Asked Questions

What Is An Expense Report?

An expense report is a document. It tracks business spending. Helps in reimbursement.

Why Are Expense Reports Important?

Expense reports help manage company finances. They ensure accurate bookkeeping. They help in budget planning.

How Do You Create An Expense Report?

Use software or templates. List expenses with dates, amounts, and receipts. Submit for approval.

What Should Be Included In An Expense Report?

Include date, amount, purpose, and receipt of each expense. Categorize expenses clearly.

Can Expense Reports Be Automated?

Yes, many tools automate them. They save time and reduce errors. Popular for businesses.

Conclusion

Expense reports play a vital role in managing finances. They help track spending and budget efficiently. Simple and organized records prevent errors and save time. Regularly updating reports ensures financial accuracy. Use user-friendly software for ease. Keep receipts for verification.

This practice aids in smooth financial operations. Start managing your expenses better today. Accurate reports lead to informed decisions. Stay on top of your finances. It’s easier than you think.