Quicken Accounting Software is a powerful tool for small businesses. It helps manage finances efficiently and accurately.

Running a small business comes with many challenges, including managing finances. Quicken Accounting Software can make this task easier. It offers features tailored for small business needs, such as tracking expenses, creating invoices, and managing cash flow. This software is designed to simplify financial tasks, saving time and reducing errors.

Whether you are a solo entrepreneur or have a small team, Quicken can help you stay on top of your finances. This introduction will explore how Quicken Accounting Software can benefit your small business and why it might be the right choice for you. Stay tuned to learn more about its features and advantages.

Introduction To Quicken

Quicken is a popular accounting software designed for personal and small business use. It helps manage finances efficiently and effectively. With a user-friendly interface, Quicken makes accounting tasks simple and straightforward.

History Of Quicken

Quicken was first introduced in 1983 by Intuit Inc. It started as a personal finance tool. Over the years, it evolved into a comprehensive accounting solution. The software has gone through many updates and improvements. Today, it offers a range of features for small business needs.

Quicken For Small Business

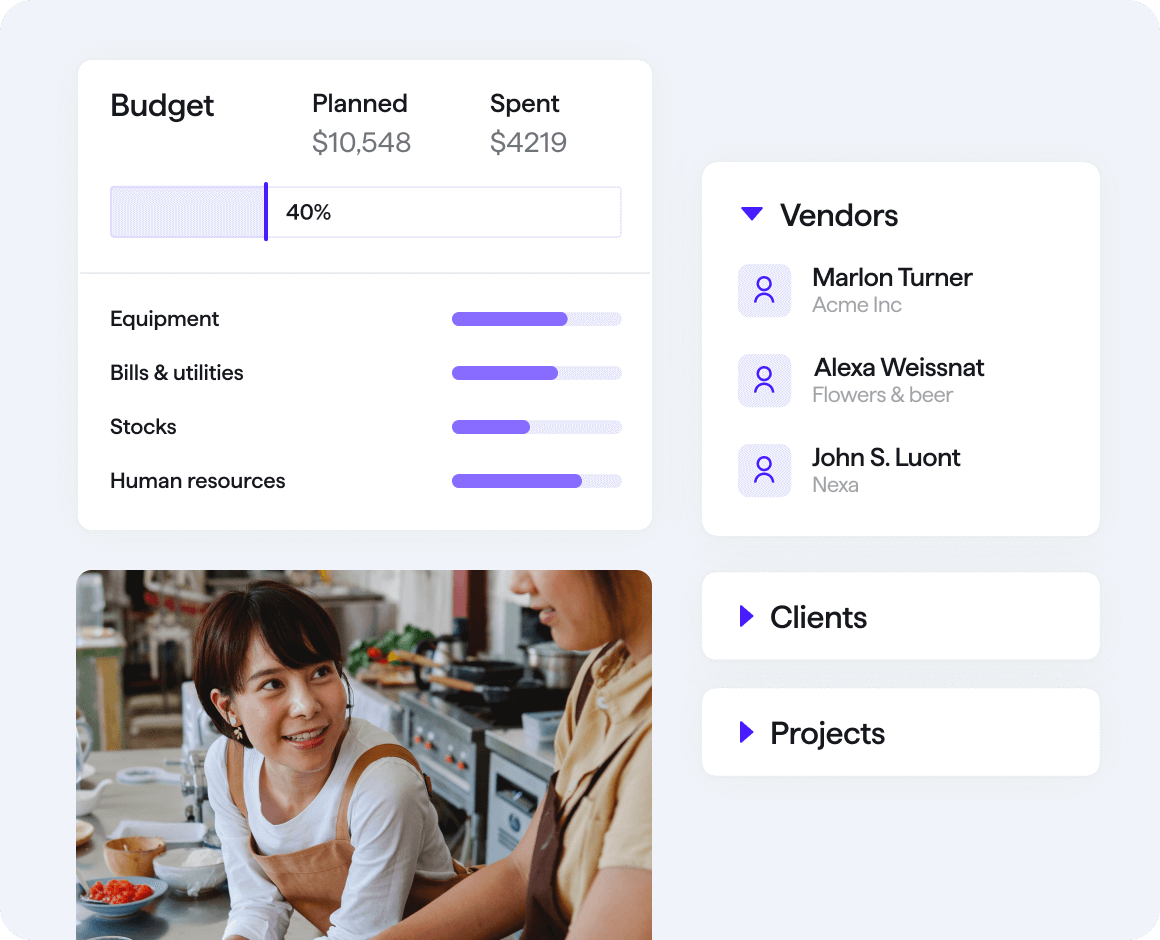

Quicken for Small Business is tailored to meet the needs of small business owners. It offers a variety of features to help manage finances effectively.

- Expense Tracking: Easily track all business expenses.

- Invoicing: Create and send professional invoices to clients.

- Budgeting: Set budgets and monitor your financial goals.

- Reporting: Generate detailed financial reports with ease.

Quicken simplifies the accounting process for small business owners. It saves time and reduces the chance of errors. With Quicken, managing business finances becomes less stressful and more organized.

Key Features

Quicken Accounting Software is a reliable solution for small businesses. It offers various features to help manage finances effectively. This section will cover the key features of Quicken that make it a great choice for small business owners.

Expense Tracking

Quicken simplifies the process of tracking expenses. It categorizes and organizes all your business expenses. This helps in monitoring where your money goes. You can upload receipts directly into the software. Quicken then matches these with your transactions.<p

- Automatic categorization: Quicken automatically categorizes expenses.

- Receipt upload: Easily upload and match receipts to transactions.

- Detailed reports: Generate detailed expense reports effortlessly.

Budget Planning

Quicken helps you create a solid budget plan. It gives you a clear view of your financial status. You can set spending limits for different categories. This ensures you stay within your budget.

- Customizable categories: Create and manage custom budget categories.

- Spending limits: Set spending limits to control expenses.

- Real-time updates: Get real-time updates on your budget status.

Quicken also provides visual aids. Charts and graphs make it easy to understand your budget. This makes financial planning more intuitive and less stressful.

“`Benefits For Small Businesses

Quicken Accounting Software offers numerous advantages for small businesses. By using Quicken, small business owners can streamline their financial processes. It saves time and ensures more accurate financial records. Below are some key benefits of using Quicken for your small business.

Time Savings

Quicken helps small businesses save a significant amount of time. It automates many financial tasks that would otherwise be done manually. For instance, Quicken can automatically categorize transactions. This means less time spent on bookkeeping. Business owners can then focus on other important tasks.

Quicken also offers a feature to set up recurring expenses and income. This ensures that regular transactions are recorded without any manual input. The software integrates with bank accounts, updating financial data in real-time. This reduces the time spent on reconciling accounts each month.

Enhanced Financial Accuracy

Accuracy is crucial in financial management. Quicken ensures that your financial records are accurate and up-to-date. It minimizes the risk of human error in data entry. The software tracks every transaction and provides detailed reports. This helps in identifying any discrepancies early.

Quicken also helps in preparing financial statements. These statements are essential for tax preparation and financial planning. Accurate records mean you can make better business decisions. Additionally, Quicken offers a feature to track and manage invoices. This helps in ensuring that all receivables and payables are accounted for.

| Benefit | Description |

|---|---|

| Time Savings | Automates tasks, sets up recurring transactions, integrates with bank accounts |

| Enhanced Financial Accuracy | Reduces human error, tracks transactions, prepares financial statements |

- Automated transaction categorization

- Real-time bank account integration

- Recurring expense and income setup

- Detailed financial reports

- Invoice management

Credit: www.quicken.com

Getting Started

Starting with Quicken Accounting Software is simple and efficient. Whether you’re new to accounting software or switching from another system, Quicken offers user-friendly tools to help you manage your small business finances with ease. Let’s walk you through the process to get you up and running quickly.

Installation Process

Installing Quicken Accounting Software is straightforward. Follow these steps to install the software on your computer:

- Visit the Quicken website and download the software.

- Once the download is complete, open the installer file.

- Follow the on-screen instructions to complete the installation.

- Launch Quicken and sign in with your Quicken account. If you don’t have an account, you can create one easily during this step.

After installing, you are ready to set up your business accounts.

Initial Setup Guide

The initial setup process helps tailor Quicken to your business needs. Follow these simple steps:

- Open Quicken and select “Get Started”.

- Enter your business name and other details.

- Add your bank accounts by selecting “Add Account”.

- Follow the prompts to connect your bank accounts securely.

- Once connected, Quicken will download your recent transactions.

After setting up your accounts, you can categorize transactions and generate reports.

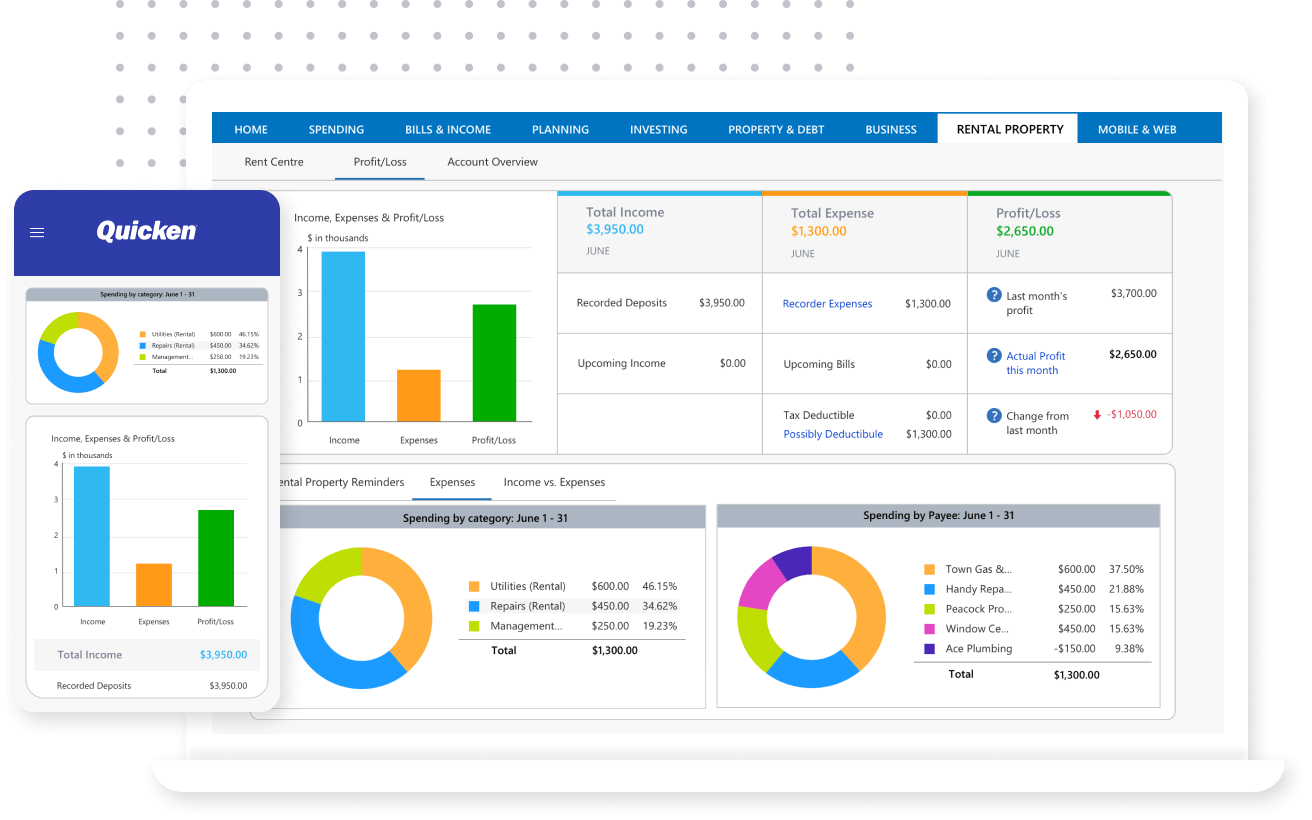

Quicken also provides a dashboard where you can view your business’s financial health at a glance. The interface is intuitive and designed to help you manage your finances efficiently.

With these steps, you are well on your way to managing your small business finances effectively using Quicken Accounting Software.

Tips And Tricks

Quicken Accounting Software is a powerful tool for small businesses. Using it effectively can save time and increase efficiency. Below are some helpful tips and tricks to get the most out of Quicken.

Maximizing Efficiency

To improve efficiency, set up automatic transactions. This saves time and ensures you never miss a payment. Use keyboard shortcuts to speed up your work. For example, use “Ctrl + N” to create a new transaction.

Another way to maximize efficiency is to customize your dashboard. Display the most relevant information for quick access. Regularly update your categories to match your business needs. This makes it easier to track expenses and income accurately.

Consider using the budget feature. It helps to keep your spending in check. Set reminders for due dates to avoid late fees.

Common Pitfalls To Avoid

One common mistake is not backing up your data. Regular backups protect you from data loss. Quicken allows automatic backups. Enable this feature in the settings.

Another pitfall is incorrect categorization of transactions. Ensure each transaction is assigned to the correct category. This keeps your financial reports accurate.

Also, avoid ignoring software updates. Updates often include important security patches and new features. Keep your software up-to-date to benefit from these improvements.

Lastly, do not neglect reconciliation of accounts. Regularly reconcile your bank statements with Quicken. This helps to spot any discrepancies early.

By following these tips and avoiding common pitfalls, you can make the most out of Quicken Accounting Software for your small business.

Credit: www.quicken.com

Credit: www.quicken.com

Frequently Asked Questions

What Is Quicken Accounting Software?

Quicken Accounting Software helps small businesses manage finances, track expenses, and generate reports easily.

Can Quicken Be Used By Small Businesses?

Yes, Quicken is suitable for small businesses. It offers tools for budgeting, invoicing, and financial tracking.

How Much Does Quicken Cost?

Quicken offers different plans. Prices range from $35. 99 to $77. 99 per year, depending on features.

Is Quicken Easy To Use?

Yes, Quicken is user-friendly. It has a simple interface and offers support for beginners.

What Features Does Quicken Offer For Small Businesses?

Quicken offers budgeting, expense tracking, invoicing, and financial reporting features. It helps manage business finances efficiently.

Conclusion

Quicken accounting software helps small businesses manage finances efficiently. It’s user-friendly and affordable. Business owners can easily track expenses, generate reports, and budget better. With Quicken, you stay organized and save time. The software offers essential tools without overwhelming complexity.

Ideal for non-accountants. Streamline your financial tasks. Give Quicken a try and see the difference it can make.